Property

When it comes to managing your property investments, you need more than just numbers on paper. You need a dedicated team of experts who understand the intricacies of property finance and taxation.

When it comes to managing your property investments, you need more than just numbers on paper. You need a dedicated team of experts who understand the intricacies of property finance and taxation.

At Wisteria Accountants, we specialise in providing top-notch Property Accountancy Services that empower property developers, landlords, and investors to maximise their returns and minimise their tax liabilities.

Our dedicated property accounting team possesses an in-depth understanding of the distinctive financial intricacies within the real estate industry. We are committed to maintaining accurate and up-to-date financial records, providing you with a crystal-clear view of your property portfolio's performance.

Navigating the constantly evolving landscape of property taxation can be a daunting task. Our team of tax specialists is here to help you develop strategic tax plans that minimise your tax obligations while ensuring unwavering compliance with the latest regulations.

Whether you're in the midst of buying, selling, or refinancing properties, our experienced advisors are your trusted guides through the complex transaction process.

Our extensive sector expertise spans Property Accountancy Services, eCommerce, Technology, Media, and Cryptocurrency. With a team of experienced Chartered Accountants, we excel at navigating industry intricacies, providing expert guidance.

We prioritise building lasting client relationships, tailoring solutions to match individual business needs. Our comprehensive approach includes strategic insights, financial planning, and ongoing support for your success in the dynamic UK property market.

Additionally, our proactive approach to regulatory compliance ensures you stay informed about tax law changes, offering peace of mind. Choose Wisteria as your dedicated partner in the ever-evolving world of business and finance.

FAQs

Personal

Business

Entrepreneur

Sectors

Can I do my own accounting?

It’s possible to do your own accounting. However, hiring an accountant can provide numerous benefits to a business. By entrusting your financial matters to a professional, you can free up valuable time and resources that would otherwise be spent on bookkeeping and tax preparation. An experienced accountant can provide valuable insights and recommendations to help you make informed business decisions, and ensure that you stay compliant with tax laws and regulations. They can also help you identify opportunities for cost savings and provide guidance on how to improve your financial performance. In short, hiring an accountant can provide a wealth of benefits to a business and is an investment that can pay off in the long run.

How can Wisteria help with inheritance tax planning?

Wisteria offers intergenerational wealth planning services, which can provide guidance on how to manage inheritance tax, particularly in areas with high property prices.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

How can Wisteria help with non-resident landlord tax returns?

Wisteria offers expert guidance on the technicalities of non-resident landlord tax options for those considering investing in the property market.

What services does Wisteria offer for landlords?

Wisteria offers a range of services for landlords, including property advice, accounting services, tax advice, and non-resident landlord tax options.

What are the benefits of hiring an accountant?

Hiring a good accountant is a wise decision for any business; an accountant can help you save money and stay on top of your finances. When you work with an experienced accounting firm like Wisteria, you can rest assured that your books are in good hands. Every business owner understands the importance of handling their financial information with care. Shelving and filing receipts and invoices, managing bank accounts, tracking payroll records and preparing tax returns are all important tasks for any business owner to complete. Hiring a professional accountant can free up your time to focus on other aspects of your business that require attention and growth.

Why should landlords consider property accounting services or tax advice?

Tax and accountancy rules for landlords and property investors are changing, and accessing property accounting services or tax advice can help landlords stay compliant and minimise their tax bills.

Why is hiring an accountant important?

A good accountant can help reduce or eliminate the time spent on financial tasks, allowing you to focus on growing your business and generating profits. The burden of handling those tasks will no longer be on your shoulders. An accountant will document your income and record how you spend your money so that you can focus on growing your business by making it more profitable.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Does Wisteria provide support to landlords and property businesses?

Yes, Wisteria works with many buy-to-let landlords and property businesses providing support in relation to accounting, financial, and tax affairs.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

What are the different types of accounting?

One of the most common types is financial accounting, which involves preparing financial statements and other reports that are used to communicate a company's financial performance to external stakeholders such as investors, creditors, and regulatory bodies. Another type is management accounting, which involves providing financial information and analysis to internal stakeholders such as executives, managers, and operational staff to support decision-making and performance management. Tax accounting is another type that involves preparing and filing tax returns for individuals and businesses, while auditing involves reviewing and assessing the accuracy and completeness of a company's financial records and reports.

What services does Wisteria offer for entrepreneurs and small businesses?

Wisteria offers a range of bespoke services, including chartered accountancy, personal tax and accountancy support, business tax services, small business consultancy, payroll services, and tax investigations.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Do I need an accountant to do tax returns?

Whether or not a business needs an accountant to prepare its tax returns depends on a number of factors. For small businesses with relatively simple tax situations, it may be possible to do the tax return themselves using online tax software or other tools. However, for larger businesses with more complex tax situations, or for business owners who are not confident in their ability to accurately prepare a tax return, it may be advisable to hire an accountant. A qualified accountant can help ensure that all relevant tax laws and regulations are adhered to, identify potential tax deductions and credits, and provide advice on tax planning strategies to help minimise tax liability. Additionally, using an accountant can help save time and reduce the risk of errors on the tax return, which can ultimately help avoid penalties or other consequences from the tax authorities.

How can you help me prepare for tax season?

As tax season approaches, an accountant can play a vital role in preparing your business for success. They can help you gather all the necessary documentation, ensure that your financial records are up-to-date, and provide guidance on tax planning strategies. An accountant can help you identify potential deductions and credits that you may not have been aware of, helping you minimise your tax liability. They can also help you navigate the complex tax laws and regulations, ensuring that your business is in compliance with all relevant tax requirements.

How can an accountant manage my cash flow?

An accountant can play a critical role in managing a business's cash flow. They can keep track of incoming and outgoing cash, monitor accounts payable and accounts receivable, and prepare cash flow forecasts to help the business plan and anticipate potential cash flow issues. Additionally, an accountant can provide advice on ways to optimise cash flow, such as by negotiating better payment terms with suppliers, implementing effective credit control procedures, and managing inventory levels. By having a clear understanding of the company's financial situation and implementing sound cash management practices, an accountant can help ensure the business has enough cash on hand to meet its short-term obligations while also having sufficient resources to invest in growth opportunities.

How can Wisteria help with inheritance tax planning?

Wisteria offers intergenerational wealth planning services, which can provide guidance on how to manage inheritance tax, particularly in areas with high property prices.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

How can Wisteria help with non-resident landlord tax returns?

Wisteria offers expert guidance on the technicalities of non-resident landlord tax options for those considering investing in the property market.

What services does Wisteria offer for entrepreneurs and small businesses?

Wisteria offers a range of bespoke services, including chartered accountancy, personal tax and accountancy support, business tax services, small business consultancy, payroll services, and tax investigations.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

What is Wisteria's experience with Fintech and Alternative Lending?

Wisteria has built up substantial experience over the last 10 years working within the HCSTC sector, providing audit, accounting, tax, and commercial support to over 40 online lenders.

How many businesses in the e-commerce sector does Wisteria act for?

Wisteria acts for over 230 businesses of all sizes within the e-commerce sector, from start-ups to companies with £20m+ turnover.

What services does Wisteria offer for landlords?

Wisteria offers a range of services for landlords, including property advice, accounting services, tax advice, and non-resident landlord tax options.

Why should landlords consider property accounting services or tax advice?

Tax and accountancy rules for landlords and property investors are changing, and accessing property accounting services or tax advice can help landlords stay compliant and minimise their tax bills.

What kind of support does Wisteria provide to Media & Technology businesses?

Wisteria provides support to many businesses of all sizes within the digital media and technology sectors, from start-ups to publically quoted companies.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Client Feedback

See what other customers have to say!

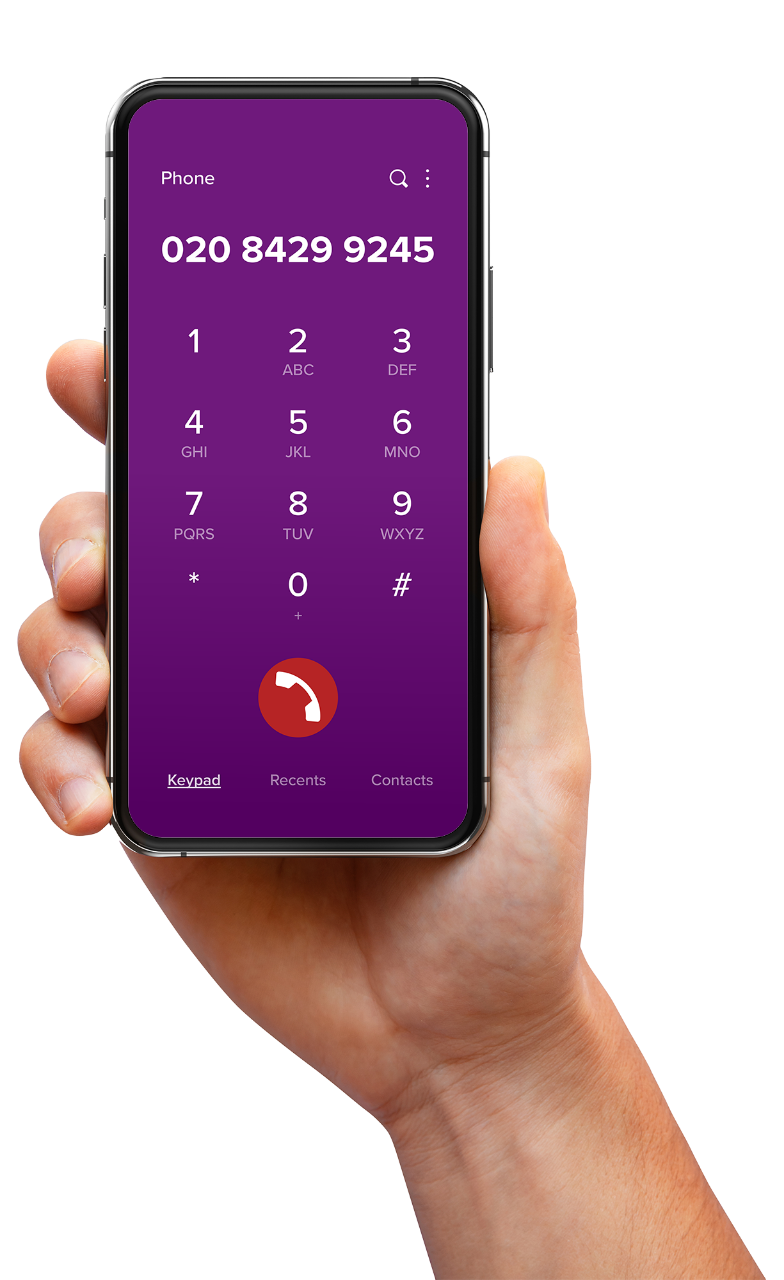

ReviewsRequest a call back

Please fill out the form below and we will contact you as soon as possible.