Back Office Services for Mature Businesses

Dealing with administration can be a drain on any business. Find out how Wisteria can support you with the day-to-day back-end services to keep your business running correctly.

Dealing with administration can be a drain on any business. Find out how Wisteria can support you with the day-to-day back-end services to keep your business running correctly.

Our Back Office Services cater to a diverse range, including small and medium-sized companies, partnerships, and mature businesses from various industries, both locally and internationally. We also offer tailored services for businesses looking to enter the UK market for the first time. With our extensive practical experience and expertise, we have developed specialist knowledge in various areas to cater to our client's unique needs and backgrounds.

Whatever business you’re in, you’re sure to see a spike in administration work from time to time. Rather than trying to manage, creating a backlog, or dragging in staff from elsewhere, why not opt for a third-party provider instead? This option is usually the most efficient use of resources.

Originally, we began offering back-office support due to demand from our existing clients. From there, we expanded this service and branched into offering this support as a stand-alone option. We have years of experience behind us and have completed many projects successfully and efficiently.

Find out what we can do for your mature business today! You could even permanently outsource tasks to us, leaving you with more time to focus on your business goals.

Wisteria provides a range of back office support services for companies, including acting as a registered office for Companies House purposes, receiving and processing post, logging and banking payments, sending out letters or marketing materials, scanning and storing large quantities of paperwork, secure document archiving and destruction, and data entry.

We can customise our services to meet your requirements, whether you have a one-off task or regular need. Contact us today to discuss how we can help you take away the admin ‘headache’.

FAQs

Business

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

What are the different types of accounting?

One of the most common types is financial accounting, which involves preparing financial statements and other reports that are used to communicate a company's financial performance to external stakeholders such as investors, creditors, and regulatory bodies. Another type is management accounting, which involves providing financial information and analysis to internal stakeholders such as executives, managers, and operational staff to support decision-making and performance management. Tax accounting is another type that involves preparing and filing tax returns for individuals and businesses, while auditing involves reviewing and assessing the accuracy and completeness of a company's financial records and reports.

What services does Wisteria offer for entrepreneurs and small businesses?

Wisteria offers a range of bespoke services, including chartered accountancy, personal tax and accountancy support, business tax services, small business consultancy, payroll services, and tax investigations.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Do I need an accountant to do tax returns?

Whether or not a business needs an accountant to prepare its tax returns depends on a number of factors. For small businesses with relatively simple tax situations, it may be possible to do the tax return themselves using online tax software or other tools. However, for larger businesses with more complex tax situations, or for business owners who are not confident in their ability to accurately prepare a tax return, it may be advisable to hire an accountant. A qualified accountant can help ensure that all relevant tax laws and regulations are adhered to, identify potential tax deductions and credits, and provide advice on tax planning strategies to help minimise tax liability. Additionally, using an accountant can help save time and reduce the risk of errors on the tax return, which can ultimately help avoid penalties or other consequences from the tax authorities.

Client Feedback

See what other customers have to say!

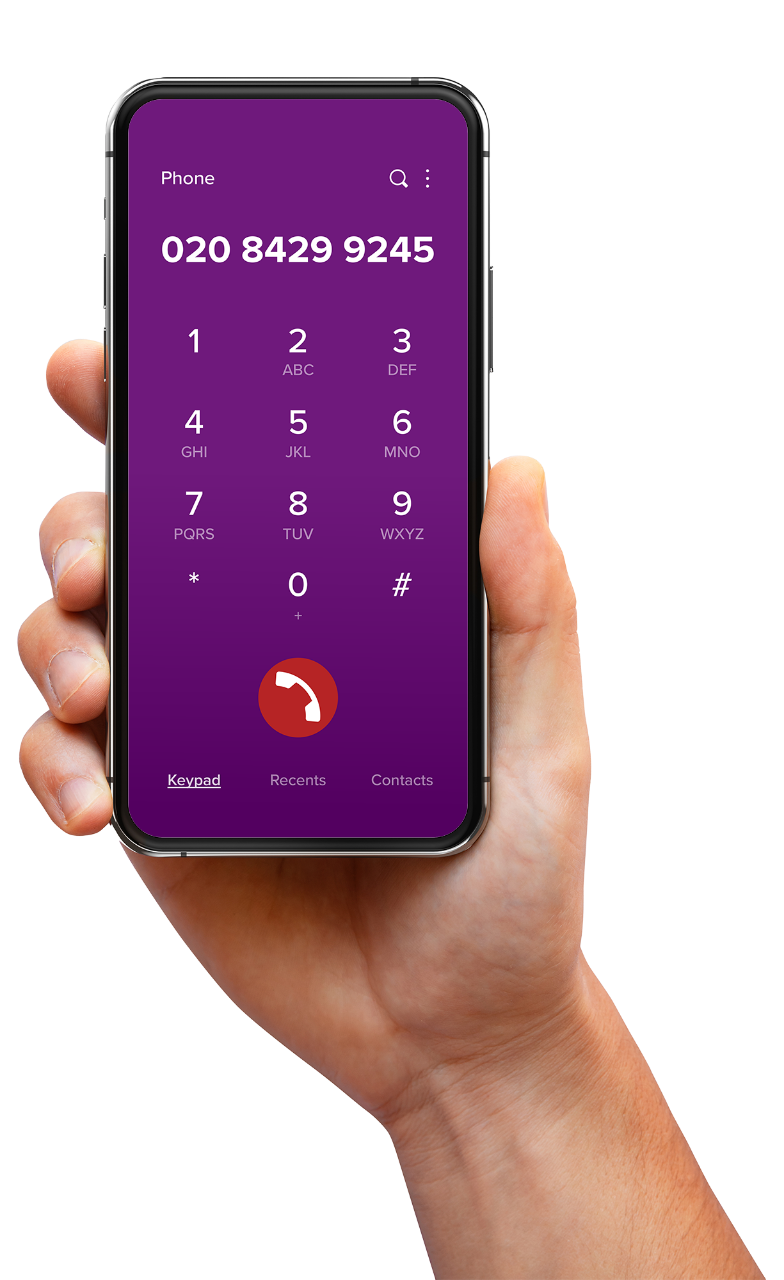

ReviewsRequest a call back

Please fill out the form below and we will contact you as soon as possible.