Dynamic accountancy firm of dedicated accountants, auditors and tax advisers

Accountants you can trust. We provide tailored accountancy and taxation services for all types of businesses and individuals.

Accountants you can trust. We provide tailored accountancy and taxation services for all types of businesses and individuals.

Tax Returns

Audits

Payroll & PAYE

Business Planning

Switch Accountants

VAT Services

We are a strong, modern accountancy firm based in the heart of North West London. Our dedicated team of specialist accountants, tax advisors and auditors provide various services to suit your business needs.

Customised Accounting and Tax Solutions for Your Business Needs Across All Industries

As an experienced accounting firm based in North West London, we strive to provide exceptional service to our clients by tailoring our solutions to meet their unique needs. Our friendly team expert accountants have vast experience working in both the public and private sectors, enabling us to offer quality services to a diverse range of clients, in the way that their business needs.

Whether you are a high-net-worth individual, a small business owner, a large company, or a professional partnership, we have the expertise to help you achieve your financial goals.

Our team of friendly and professional accountants cover the whole of the UK and internationally, providing clients with a comprehensive range of accounting services. From bookkeeping and tax compliance to payroll management and year end reporting, we have the expertise to help you achieve your financial objectives. We pride ourselves on delivering an expert service in a friendly and professional way, with fees that reflect the quality of service we deliver.

If you're looking for a team of accountants that understands your business and can help you achieve your personal and financial objectives, get in touch with us today. We would be happy to discuss how our services can benefit your business and provide you with a tailored solution that meets your needs.

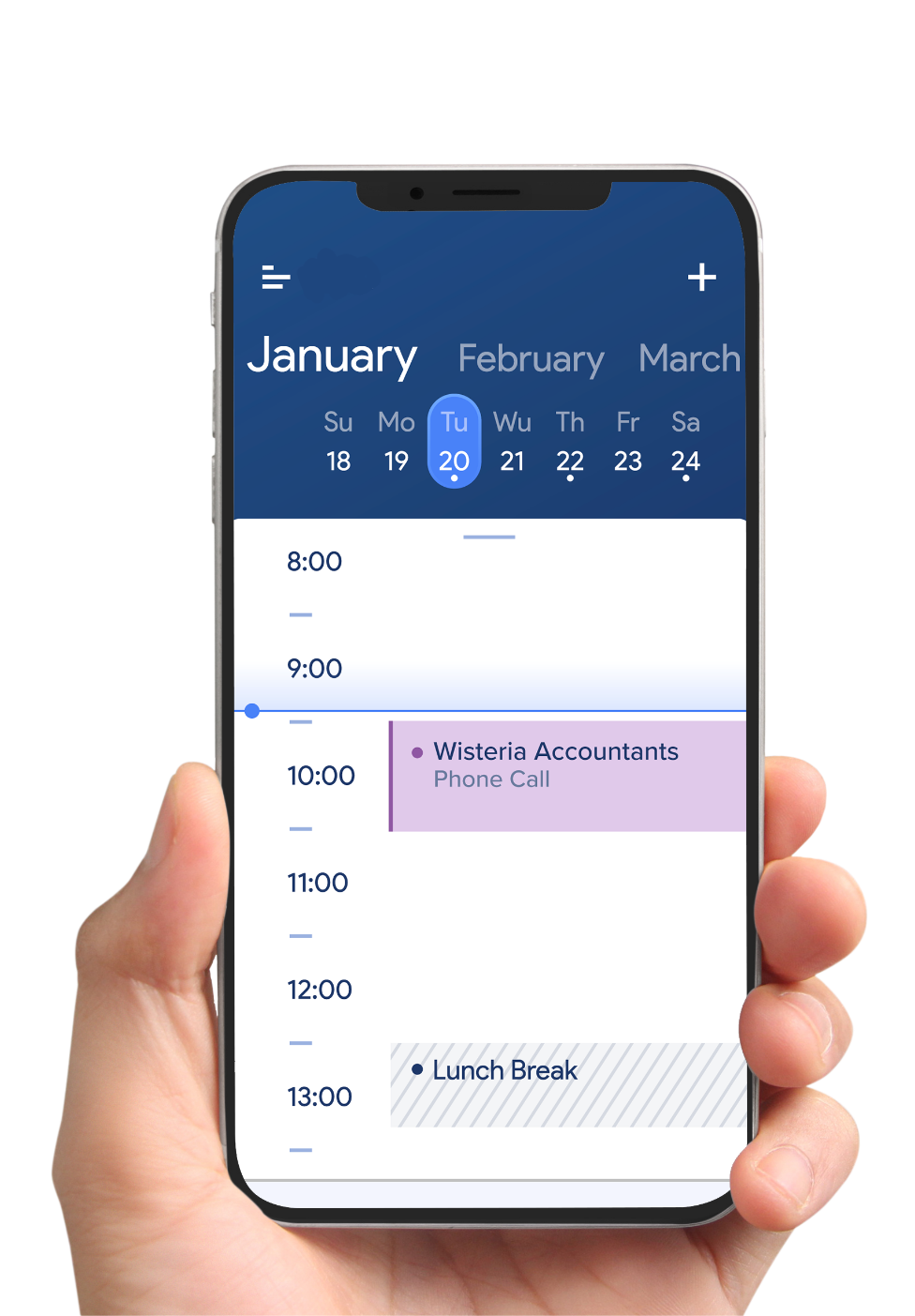

Wisteria Accountants

The Grange Barn, Pike's End Pinner London, HA5 2EX

Accountants and advisors that speak your language

At Wisteria, we understand that running a business can be complex and challenging, especially when it comes to finance, tax and regulatory issues. That's why we believe in taking a proactive approach, identifying potential issues before they become problems and providing tailored solutions that meet your specific needs.

From cash flow forecasting to payroll services, we can help you to navigate the complexities of accounting and finance, allowing you to focus on what you do best – growing your business.

Our team of skilled accountants stays updated with the latest industry trends and regulations to deliver top-notch service. We leverage advanced accounting software and technology to maintain precise, current, and easily accessible financial records. This enables us to dedicate our time to enhancing your business instead of getting bogged down in data entry tasks.

With Wisteria, you can rest assured that your finances are in good hands, giving you the peace of mind you need to focus on what really matters – running and growing your business.

How Wisteria Accountants Can Help

Personal

Our team of innovative finance professionals are committed to giving you an honest assessment of your situation at all times. We offer a wide range of bespoke services and expertise tailored to suit all your financial accounting and tax decisions. The personal accounting services we provide include: tax advice, self assessment tax returns and a range of personal tax planning and consultancy services.

Entrepreneur

Wisteria offers effective and affordable accounting services for entrepreneurs and high-profile individuals, including specialised expertise in cryptocurrency & NFTs, landlord accounting, and intergenerational wealth planning. Our team of qualified Chartered Accountants provides non-statutory audits, self assessment tax and tax investigation services to ensure financial statements are accurate and compliant. Trust Wisteria to support your daily operations, from business consultancy to payroll services and income tax.

Businesses

With the help of our expert accountants and consultants, you can be sure that your business is in the hands of experts who will take the time to get to know your company, understand your goals and explain the options open to you. We offer a range of business services for more mature businesses including company secretarial, auditing, auditing reviews, taxation advice and business planning and valuations

Sectors

As accountants, you can rely on Wisteria to provide efficient and cost-effective advice for property, eCommerce, technology, media, and cryptocurrency sectors. We specialise in helping businesses and investors in these sectors make the most out of their investments by providing them with professional advice. Our team of qualified professionals is trained to support your daily business operations. We provide a range of accounting services for businesses and investors, including tax returns, financial statement preparation, and auditing services.

Get confidential expert advice!

Let's talk!Personal, Business and Entrepreneurs Tax

Allow Wisteria to support you in effectively managing your business' tax affairs. We are committed to developing a successful tax strategy tailored to your specific needs. Our approach focuses on understanding your unique situation, maintaining open lines of communication, and assisting you with your medium and long-term objectives.

With our expertise, you can rest assured that your tax matters are in capable hands. By doing so, you and your business can take full advantage of all eligible tax reliefs and maximise your savings. With Wisteria, expert personal, business, and entrepreneurial tax advice is readily available to you.

How can we help you?

You run your business, we'll take care of your tax!

Why choose Wisteria Accountants?

Expert Team Members

0

Years of Experience

0

Happy & Active Clients

0

Days in Business

0

Wisteria Accountants is a young, dynamic accountant firm of dedicated professionals who have a passion for being every client’s number one advisers, providing expertise and a friendly service for life. We take pride in our people - their energy, enthusiasm and eagerness to learn. It’s what keeps us moving forward while holding true to our vision to be an innovative accountancy practice that delivers exceptional client experiences.

With our expertise in finance and accounting, we have built a reputation for delivering high-quality services at competitive rates. As well as core services, we are known amongst our clients for going above and beyond our core services, such as working with clients to raise finance, manage their bank payments or arrangements and even arranging introductions between clients who can support each other. Our aim is to give you peace of mind by ensuring that your business performs to the optimum level.

We understand that every business is unique and has its own set of challenges and goals. That's why we take a personalised approach when working with our clients. Our team of professionals will work closely with you to understand your business needs and tailor our services to fit your specific requirements. We are committed to providing practical solutions that are both effective and efficient, so you can focus on what you do best - running your business. Let us take care of the accounting and financial side of things, while you concentrate on growing your business and achieving your goals.

Client Feedback

See what other customers have to say!

ReviewsAt Wisteria Accountants, we use the most efficient platforms available to meet your accounting needs. We provide training and support to ensure that you can use each software effectively.

What is Xero?

Xero is a cloud-based accounting software that allows businesses to perform many bookkeeping functions like invoicing, bank reconciliations and payroll. With Xero, you can stay on top of your finances and make informed decisions, no matter where you are. The benefits of Xero are endless, making it the perfect choice for businesses looking to take control of their finances and reach their full potential.

Getting started with Xero?

Xero is designed to be user-friendly and accessible for all. You can import your existing data, connect your bank accounts and set up your invoicing and payroll processes in no time. With Xero, you'll have access to a wide range of features and integrations to help you manage your finances efficiently and effectively. Whether you're working from your office or on the go, Xero makes it easy to stay connected to your financial information.

What are the benefits of Xero?

Xero is the ultimate solution for businesses looking to streamline their bookkeeping processes. With Xero, you can easily manage all of your financial tasks in one place, from invoicing and expenses to payroll and tax calculations. This innovative software saves you time and effort, so you can focus on growing your business. Xero is easy to use and comes with a range of powerful features, including real-time collaboration with your team, automatic bank feeds, and multi-currency support. Latest technology uses machine learning and AI to make as much of the data entry automatic, freeing up time to focus on more important issues.

How we can help you with Xero?

Whether you are looking to fully outsource your book-keeping and reporting, or want to play an active part in keeping your records up to date, we understand that getting the most out of Xero requires a solid understanding of the platform. As a Xero bronze partner, we have a team of dedicated in-house experts who are passionate about Xero and have the knowledge and experience to assist you. With our services, you'll be able to quickly and easily master the platform and start reaping the benefits of Xero. Don't wait, contact us today to find out more about our Xero training services!

If you would like to know more go to

Xero Services

Latest News

FAQ

Personal

Entrepreneur

Business

Sectors

Can I do my own accounting?

It’s possible to do your own accounting. However, hiring an accountant can provide numerous benefits to a business. By entrusting your financial matters to a professional, you can free up valuable time and resources that would otherwise be spent on bookkeeping and tax preparation. An experienced accountant can provide valuable insights and recommendations to help you make informed business decisions, and ensure that you stay compliant with tax laws and regulations. They can also help you identify opportunities for cost savings and provide guidance on how to improve your financial performance. In short, hiring an accountant can provide a wealth of benefits to a business and is an investment that can pay off in the long run.

How can Wisteria help with inheritance tax planning?

Wisteria offers intergenerational wealth planning services, which can provide guidance on how to manage inheritance tax, particularly in areas with high property prices.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

How can Wisteria help with non-resident landlord tax returns?

Wisteria offers expert guidance on the technicalities of non-resident landlord tax options for those considering investing in the property market.

What services does Wisteria offer for landlords?

Wisteria offers a range of services for landlords, including property advice, accounting services, tax advice, and non-resident landlord tax options.

What are the benefits of hiring an accountant?

Hiring a good accountant is a wise decision for any business; an accountant can help you save money and stay on top of your finances. When you work with an experienced accounting firm like Wisteria, you can rest assured that your books are in good hands. Every business owner understands the importance of handling their financial information with care. Shelving and filing receipts and invoices, managing bank accounts, tracking payroll records and preparing tax returns are all important tasks for any business owner to complete. Hiring a professional accountant can free up your time to focus on other aspects of your business that require attention and growth.

Why should landlords consider property accounting services or tax advice?

Tax and accountancy rules for landlords and property investors are changing, and accessing property accounting services or tax advice can help landlords stay compliant and minimise their tax bills.

Why is hiring an accountant important?

A good accountant can help reduce or eliminate the time spent on financial tasks, allowing you to focus on growing your business and generating profits. The burden of handling those tasks will no longer be on your shoulders. An accountant will document your income and record how you spend your money so that you can focus on growing your business by making it more profitable.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Does Wisteria provide support to landlords and property businesses?

Yes, Wisteria works with many buy-to-let landlords and property businesses providing support in relation to accounting, financial, and tax affairs.

How can you help me prepare for tax season?

As tax season approaches, an accountant can play a vital role in preparing your business for success. They can help you gather all the necessary documentation, ensure that your financial records are up-to-date, and provide guidance on tax planning strategies. An accountant can help you identify potential deductions and credits that you may not have been aware of, helping you minimise your tax liability. They can also help you navigate the complex tax laws and regulations, ensuring that your business is in compliance with all relevant tax requirements.

How can an accountant manage my cash flow?

An accountant can play a critical role in managing a business's cash flow. They can keep track of incoming and outgoing cash, monitor accounts payable and accounts receivable, and prepare cash flow forecasts to help the business plan and anticipate potential cash flow issues. Additionally, an accountant can provide advice on ways to optimise cash flow, such as by negotiating better payment terms with suppliers, implementing effective credit control procedures, and managing inventory levels. By having a clear understanding of the company's financial situation and implementing sound cash management practices, an accountant can help ensure the business has enough cash on hand to meet its short-term obligations while also having sufficient resources to invest in growth opportunities.

How can Wisteria help with inheritance tax planning?

Wisteria offers intergenerational wealth planning services, which can provide guidance on how to manage inheritance tax, particularly in areas with high property prices.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

How can Wisteria help with non-resident landlord tax returns?

Wisteria offers expert guidance on the technicalities of non-resident landlord tax options for those considering investing in the property market.

What services does Wisteria offer for entrepreneurs and small businesses?

Wisteria offers a range of bespoke services, including chartered accountancy, personal tax and accountancy support, business tax services, small business consultancy, payroll services, and tax investigations.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

What are the different types of accounting?

One of the most common types is financial accounting, which involves preparing financial statements and other reports that are used to communicate a company's financial performance to external stakeholders such as investors, creditors, and regulatory bodies. Another type is management accounting, which involves providing financial information and analysis to internal stakeholders such as executives, managers, and operational staff to support decision-making and performance management. Tax accounting is another type that involves preparing and filing tax returns for individuals and businesses, while auditing involves reviewing and assessing the accuracy and completeness of a company's financial records and reports.

What services does Wisteria offer for entrepreneurs and small businesses?

Wisteria offers a range of bespoke services, including chartered accountancy, personal tax and accountancy support, business tax services, small business consultancy, payroll services, and tax investigations.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Do I need an accountant to do tax returns?

Whether or not a business needs an accountant to prepare its tax returns depends on a number of factors. For small businesses with relatively simple tax situations, it may be possible to do the tax return themselves using online tax software or other tools. However, for larger businesses with more complex tax situations, or for business owners who are not confident in their ability to accurately prepare a tax return, it may be advisable to hire an accountant. A qualified accountant can help ensure that all relevant tax laws and regulations are adhered to, identify potential tax deductions and credits, and provide advice on tax planning strategies to help minimise tax liability. Additionally, using an accountant can help save time and reduce the risk of errors on the tax return, which can ultimately help avoid penalties or other consequences from the tax authorities.

What is Wisteria's experience with Fintech and Alternative Lending?

Wisteria has built up substantial experience over the last 10 years working within the HCSTC sector, providing audit, accounting, tax, and commercial support to over 40 online lenders.

How many businesses in the e-commerce sector does Wisteria act for?

Wisteria acts for over 230 businesses of all sizes within the e-commerce sector, from start-ups to companies with £20m+ turnover.

What services does Wisteria offer for landlords?

Wisteria offers a range of services for landlords, including property advice, accounting services, tax advice, and non-resident landlord tax options.

Why should landlords consider property accounting services or tax advice?

Tax and accountancy rules for landlords and property investors are changing, and accessing property accounting services or tax advice can help landlords stay compliant and minimise their tax bills.

What kind of support does Wisteria provide to Media & Technology businesses?

Wisteria provides support to many businesses of all sizes within the digital media and technology sectors, from start-ups to publically quoted companies.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Request a call back today!

Fill out the form below to request a call back from one of our experts. Our team is dedicated to providing top-notch customer service and will be happy to answer any questions you may have.